Financial Advice and Investment Strategy

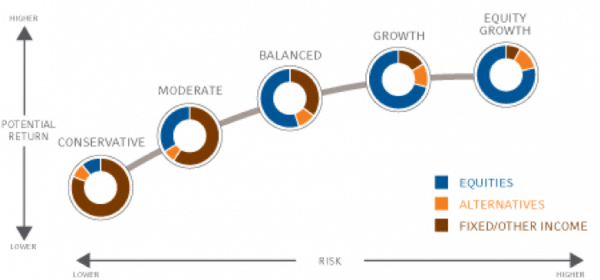

At Strategic Financial Advice we offer a range of investment strategies depending on your investment/risk profile, which are determined from our lifestyle and investment discussions.

We provide you with a comprehensive report so that you better understand your future financial position;

We understand your concerns around the cost of retirement, the cost of

managing your retirement as well as how much retirement will cost you.

We’re here to help you understand your financial position, reduce your costs, increase your savings and improve your retirement possibilities.

Understanding Your Financial Position

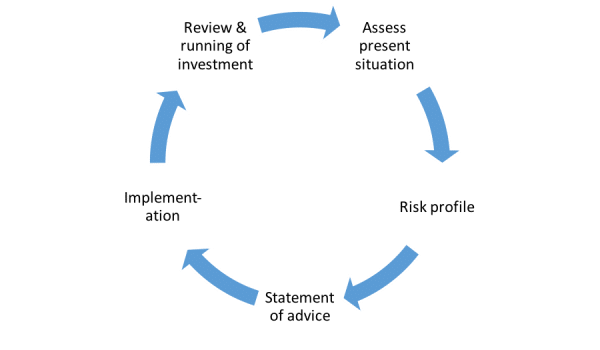

A. Assess present financial situation, goals and objectives

- Assess your present financial position

- What is your current employment status and is it secure?

- Decide on your goals and objectives

- Determine the outcome of your objectives, i.e. Where will your goals

and objectives see you in five years time? - Prioritise your goals and objectives

- Consider how much money you’ll need to invest and the limitations

of achieving your plan - Test your idea against two variables – Does this plan make economic

sense and will the outcome provide you the lifestyle you aspire to?

B. Financial Risk profile to assess your investment choice

The profile will determine your attitude to risk and your potential return on investments depending on:

- How familiar are you with investing?

- How long have you been an investor?

- How long would you need to invest your funds for, giving consideration to your goals and objectives?

- What scale of risk are you comfortable with?

- What type of investments interest you?

C. Statement of Financial Advice

Our Possible Investment and Risk Recommendations

An Investment Platform:

- Offering consolidated reporting, including online reporting

- Annual tax reports

- Allows you to change and mix your investments quickly & easily as your needs or market changes

- Reduces your direct exposure to market movements

SMSF Investment Strategies:

- Strategies designed to give capital growth, income growth or simply to manage investment volatility

- Review of investment structure to ensure that this add value to your portfolio

- Advice on various ETFs (Exchange Traded Funds) and direct share investments

Superannuation Planning:

- Accumulation through contributions

- Working out the best time to start account based pensions for cash flow & tax effectiveness

- Making sure wealth is properly & effectively transferred to those people that you want it to go to

- Explaining binding and non binding nominations as well as

reversionary interests

Estate Planning:

- Death benefits from your SMSF / superannuation / investments

- Checking over and arranging to have wills and powers of attorney drafted through our network of legal professionals

- Helping to work out whether a testamentary trust may assist if something happens to you

- Binding and non binding nominations for your superannuation

- Ensuring that the people that you want to benefit receive those benefits if something happens to you

Insurances and planning:

- Life insurances

- Investment bonds

- Income protection

- Ensuring that your current insurance or the insurance chosen compliments your financial goals

D. Implementation of your plan and reviewing the Statement of Advice:

- Ensuring you’re happy with the advice moving forward

- Client to sign ‘Authority to proceed’

- Accept recommendations

- Implement a tailored plan, such as purchasing investments, investment structures, insurances etc.

E. Review and running your investments:

Our review process includes:

- Steps you’ve already taken toward achieving your goals

- Assessing if your needs have changed

- Analysis of cash flow/pension strategies

- An update of economic conditions that may affect your investments

- Legislative updates that may impact your situation

- Ensuring your investment strategy is up to date

- Investment performance review

- Investment availability & suitability

Strategic Financial Advice

Suite 2, 319 Keilor Road

Essendon Vic 3040